Those who are looking to build a career in Accounting, Taxation, Audit & Finance can obtain a new PG-Diploma called “Chartered Tax Practitioner” (CTPR). This qualification is suitable for those who can’t pursue CA, CMA courses for various reasons.

What is Chartered Practitioner Course?

CTPr is a professional certification program offered by “The Institute of Chartered Tax Practitioner – India” headquartered in Bangalore. The certificate is jointly awarded by MEPSC (Management Entrepreneurship & Professional Skill Council of India)”, under the aegis of Ministry of Skill Development, Govt. of India.

According to the official website ictpi.in “the primary objective of the institute is to provide recognition to enrolled tax professionals, train & provide for continued professional development. Further, the Institution is not in competition with other statutory bodies like ICAI, ICMA or Bar council.

How to become a CTPr?

There are 4 topics to study which is split into 2 modules. After enrolling to the course (see eligibility below) you must complete the course & pass the exam within one year. Therefore, it’s suggested to complete the entire course in 2 semesters.

Module 1: There are 2 subjects in this module – a) Applied financial accounting and b) Business regulatory laws & compliances.

Module 2: In this module you have to study a) Direct tax laws compliance and b) Indirect tax law compliances.

Examination: You must pass the exam by scoring minimum 50% in each modules. For each module there is a 3 hours OnDemand online exam through PearsonVue exam center.

After passing the exam you have to undergo some practical training and professional orientation training before University convocation.

Eligibility & Fee Structure

Candidates must be a commerce graduate. Enrolled tax practitioners, CA, CMA inter pass & Advocates who are member of Bar can also apply.

Fee Structure

- Course registration fee Rs 40,000/- (Rs 25,000 upon admission & Rs 15,000 on convocation)

- Exam Fees Rs 6,000/- (Rs 3,000 each)

- Post Qualification Orientation Fees Rs 5,000/- (Payable after passing exams)

- Associate Membership Rs 3,500/- (payable with orientation fees)

Career Options for CTPR

You can start practicing as a Tax consultant (both GST & Income tax), provide accounting, legal & other statutory compliance services to businesses (mainly to MSME sector). You can also join Audit firm.

There is shortage of qualified Tax professionals in tier-3 & 4 cities across the nation. After implementation of GST, a qualified Tax consultant & accountant is needed in every villages.

CTPR is a NSQF level-5 qualification as per National Qualification Registrar NCVEt .

International comparability

- British Qualification: AAT Level 4 End-Point Assessment for Professional Accounting or Taxation Technician, RQF 610/0289/6

- British Qualification: OCR Level 7 Diploma in Professional Services (Tax Practice) (QCF)

- Australian Framework: FNSSS00003 – Tax Practitioner Skill Set

- Australian Framework: FNSSS00008 & FNSSS00009

Visit official website Ictpi.in for more information about Ctpr.

If you don’t want to practice as ‘Tax consultant’ you can optionally enroll for CPA course as progression pathway.

Certified Public Accountant (CPA)

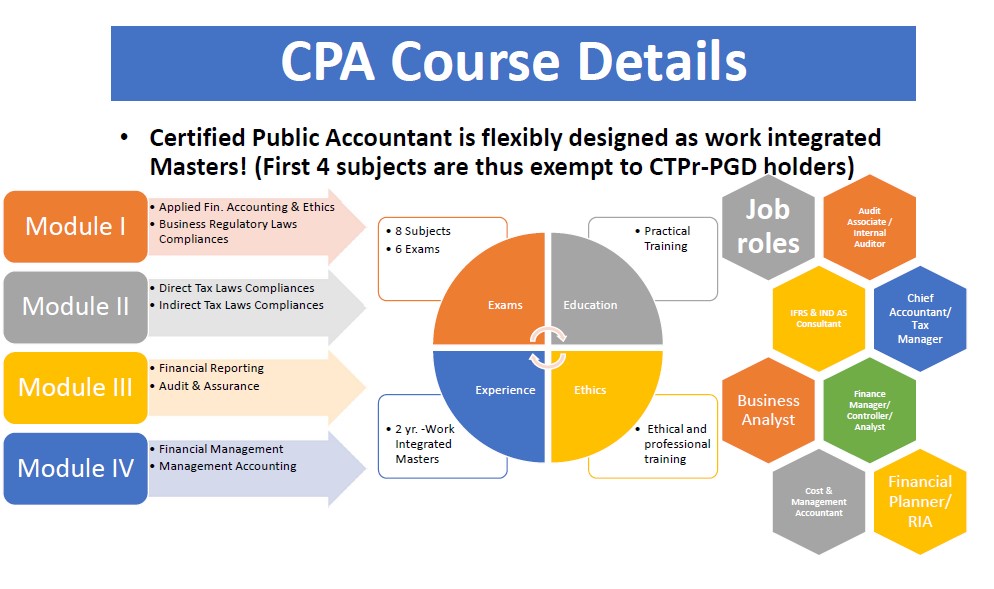

CPA (or Certified Public Accountant) is a work integrated Masters Degree program in Accounting & Finance. There are 2 modules & 4 subjects. This course is suitable for those who are looking for highly rewarding Financial management career opportunities in BIG multi-national companies.

There are 4 subjects 1) Financial reporting, 2) Audit & assurance, 3) Financial management 4) Management accounting. These are tough subjects similar to CA, CMA final. However, these difficulty level is what makes it competitive and worth perusing.

The advantage of CPA course is that there are only 4 subjects & you can take individual exams as & when you wish. So you can concentrate on one subject for 3 months & pass the exam and complete the course in one year!

Eligibility & other info

If you have completed CTPR course then you are already qualified to enroll for CPA course. If you are not a CTPR then you have to complete all the 4 modules (8 subjects & 6 exams). For more informaton please visit official website ICPA.org

What’s after CTPR & CPA?

How about getting globally recognized qualification like AICPA (USA) or ACCA, CIMA (UK). If you are interested in continuing your professional qualification this is a easier short cut. See below.

Conclusion by Editor

The designation title of “Chartered” is very reputed one with high brand value & instant-recognition. Commerce graduates and accounting/taxation professionals can now get this prestigious designation with some effort to give a boost to their career.